My name is Chris Corwin Gayle and I am a trader and Trading System developer. The purpose of this article is to break down the concept of Unusual Options Activity into simple language and show you exactly how to use it profitably.

There are numerous sources online that are just outright misrepresenting what UOA is and how it is used. And I want to correct some of the myths out there. I feel like I have the authority to do this because I have been trading UOA for many years now and have built many filters and Unusual Options Activity scanners over the years. I know the flow. Anyway, thats enough talking. Let’s get to it.

What Is Unusual Options Activity?

Unusual Options Activity is the occurrence of anomalies in Options Order Flow . Most people tend to confuse order flow with unusual activity but, as you will see, they are not quite the same. Options order flow is just the real time transactions in the Options markets. The anomalies that count as unusual include large $ trades, large trade size relative to Open Interest, Sweeps & repeat buying.

A lot of services sell Order Flow data but very few actually sell real UOA.

Why Trade UOA?

A large amount of the daily volume in the options market is produced by institutions, hedge funds , successful private investors, and other experienced traders. This group is savvy, well informed and use a variety of different strategies. This group is known collectively as the “Smart Money”. So, tracking their daily activity gives important insights into what the smart money is doing with regards to a particular stock, sector or even the whole market and you can benefit from tracking this info.

Simply put, you can get profitable trade ideas!

6 Facts You Need To Know & Accept Before You Trade UOA

(1) UOA should be used to supplement an existing strategy. You should have a core Trading Strategy and then use UOA as just an additional tool.

(2) UOA is NOT an exact science so it is subject to a lot of “trader’s intuition”

(3) Experience & trader’s intuition play a big part in deciding which UOA trades to take. So the more you see it, the better you will track & trade it.

(4) Even the smart money gets it wrong sometimes so don’t expect miracles. Be realistic and don’t be greedy.

(5) You can never know for sure what the intent of the buyer is or whether a particular trade is a hedge or straight speculative play.

(6) In most cases, those who initiated the trades have deep pockets & can

How To Tell If The Unusual Options Activity Contracts Are Bought Or Sold

The truth is that we can never be 100% sure if the contracts were bought or sold. The way the market works is that there is always a buyer for every seller and a seller for every buyer.

So it is more important to look at who initiated the trade to get an idea of what the intent of the trader is and the sort of outcome that we can expect. Even so you still won’t be 100% sure but there are ways that can make us about 99% sure:

Here are a few:

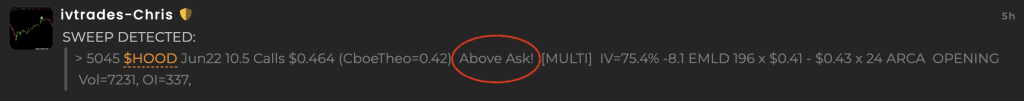

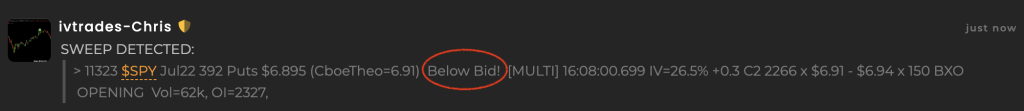

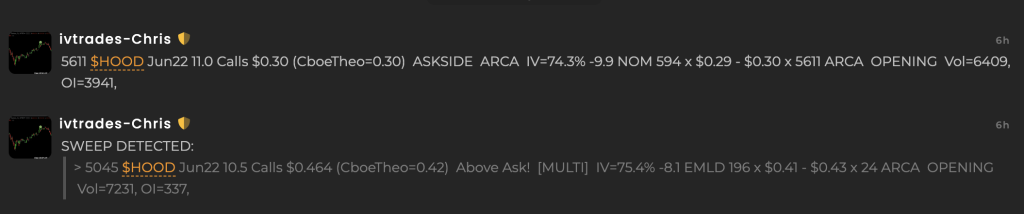

- Looking @ the Bid & Ask: When a lot of trading activity is on the Askside, chances are buyers are initiating the trade. This is true regardless of whether it is a Put or Call.

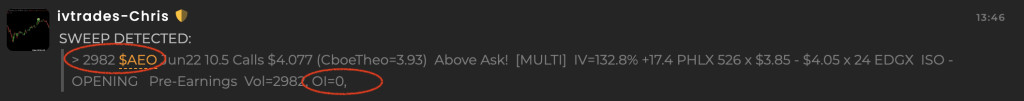

- Looking @ Volume vs Open Interest: When Volume is significantly higher than Open Interest, chances are the activity is an opening transaction/Buy.

- Looking @ Implied Volatility (IV): If there is demand for the options, the IV will move. Changes in IV can confirm bullish or bearish sentiment and show whether we have Buying or Selling taking place.

I can confidently say 99% because these days sophisticated algos have analyzed decades of options flow data and backed up the conclusions drawn above. I have all these built in my filter so every trade you see there meets these criteria.

How To Identify Unusual Options Activity

- Trades that go off at or above the Ask if you are interested in long trades

- Trades that go off at , or below, the Bid if you are interested in selling/shorting contracts

- Trades that have a big size relative to the Open Interest & the Average Daily Volume for that Option Contract

- Trades with repeat buying in a short period of time

How To Setup & Execute Unusual Options Activity Trades

Step 1: Setting Up Your Trades

After you have identified the UOA, there are a few things that you can do to set up your trade and increase the probability of making profitable trades:

Check the news for possible catalysts : You want to take a quick look at all the news concerning the stock in question just to see if there is any event coming up that might serve as a catalyst and help to explain why there is UOA in the stock at this time. If you don’t find any news then it is not a big deal because the assumption is that whoever is behind the trade likely knows something that is not yet public information. In fact, when you do find some news it will likely be related to an upcoming event like earnings, an FDA announcement or an Investor Day etc.

Look at past UOA Flow if you can: By looking at the past flow, you can see if there has been prior action in the name and when that action usually occurs and what the outcome usually is. This can give you an idea about what to expect from the current UOA flow that you are seeing. You can look at the past flow right here on the UOA dashboard.

Look at the Industry/Sector peers: If your stock is the only one catching UOA flow in its sector then it usually means that there might be something about to take place regarding that stock in particular. But if the other names in the sector are seeing UOA flow as well it usually means you might be seeing a rotation into the entire sector ahead of further movement.

Take a look at the technical picture: Pull up a chart and take a look at the technicals. If the technicals are bullish along with bullish flow then it is usually a good sign. Similarly, if the technicals are bearish along with bearish UOA flow it is also a good sign.

By doing these simple things, you are basically just looking for info/evidence that supports the flow that you are seeing. But, an absence of evidence is not always a bad thing because, by definition, the smart money knows things that we do not….things that have not begun to show up in the news or the price action/charts as yet.

Step 2: Executing Your Trades

After you have found and set up your trades, now it is time to pull the trigger but you want to do so intelligently and efficiently. You don’t want to just jump in. Here is how you execute the trades:

You can trade the underlying stock or the same Options contracts: Trading the underlying stock has many advantages. For instance, you wouldn’t have to worry about time decay and it is also a great alternative if the Options seem a little illiquid.

Get the same strike & expiration: Ideally, you want to buy the same strike and expiration that are active but it is ok to buy a further out expiration @ the same strike. In other words, if you are going to change the expiration make sure it is further out but you should never change the strike price.

Use sensible position sizes: Your position sizing is very important. In fact, the size of your position is one of the few things that you have control over when trading. Personally, I never allocate more than 1%-5% of my risk capital to any single trade.

Adjusting for fills: Many times you will not get the exact fill that you see on the UOA. Generally, it is ok to chase it up to .50 or so. But ultimately it depends on how the contracts are priced. If it is a penny or dime or quarter or 50 cent increment option then 50 cents is the standard. Dollar Options are different….for instance an AMZN Call trading @ 1200 can probably be chased up to 1350 or so.

Step 3: Managing Your Trades

Once you have found your trades, set them up and gotten filled, you will now have to manage your positions to make sure that you get the most out of them. This is how you do it:

How To Set Stops: We generally have no idea what the big trader’s time frame or intention is. So UOA trades need room and time to work which means that stops have to be wider than usual. This is another reason why your position size is important because you don’t want huge exposure with very wide stops.

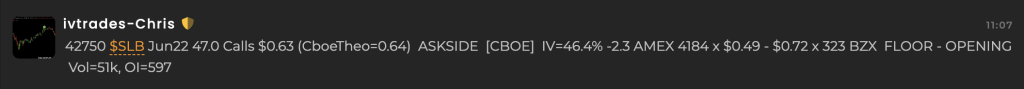

Using the ATR: Stops should not be set on on the Option Contracts if you can avoid it. Stops should be set on the underlying stock using 1.5 to 2.0 x ATR. ATR= Average True Range. You simply set an alert on the underlying & sell the contract when it goes off. Lets take a look @ this UOA on (SLB) as an example of how stops are set:

This is the UOA in Slumberger (SLB)

This is the Daily chart SLB right after the UOA:

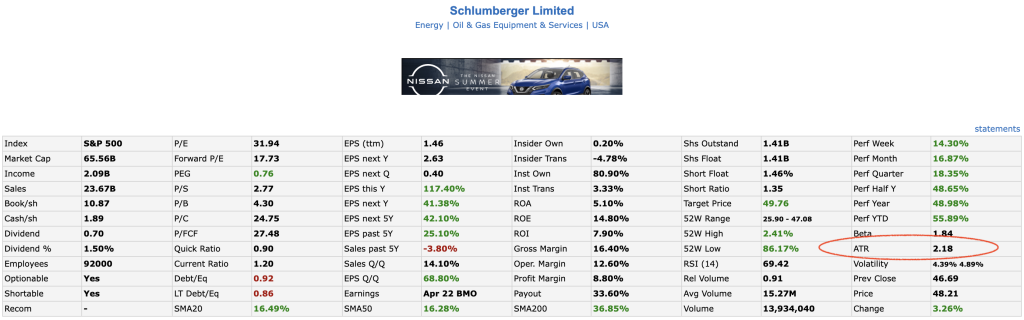

In order to set the stop we will need the ATR and you can find it easily on any trading platform or on Finviz.com as you see below:

So let’s say we decide to use a stop that is 1.5x the ATR. Then we would simply multiply 2.18 x1.5 =3.2. We would then subtract 3.27 from 46.35.

The 46.35 is the price at which SLB was trading when we bought the Calls. So we would have 46.35-3.27 =43.08. This means our stop on the underlying stock would be @ 43.08.

Even when using the ATR you will get stopped out from time to time before the trade pays out. But it is better to get stopped out and re-enter than to take a big loss.

Track the Open Interest (OI): Once you are in the trade you should track the Open Interest changes to see if the original position is being reduced, increased or closed. Sometimes the smart money closes out and moves on and retail buying carries the trade for a few points more before it collapses due to lack of real/big money support. You don’t want to be left holding the bag, so check OI.

Step 4: Exiting Your Trades

There are a few different ways to exit your trades ( assuming you are not stopped out). Here they are:

Using a Pre-Set Target: You can get in the trade and then set a pre-set target to exit. This could be a certain %, a number of points on the underlying stock, some key support or resistance level or just an ATR multiple. Using an ATR multiple would be simply using the same steps we used to set the stop on SLB but you would be adding to the underlying stock price instead of subtracting. For instance, if we chose a target of 3x ATR, our Profit Target would be 46.35 + ( 3 x2.18)= 52.89.

Using a Trailing stop: You can get in the trade and then set a trailing stop to keep locking in gains and following the trend. This is more of a Trend Following approach that will help you to get the maximum gains out of the trade.

Open Interest Changes: You can start to wind down your position when the Open interest begins to dwindle. This is just a common sense approach as sharp drops in OI pretty much tells you that the big money is taking profits.

Expired Catalyst: If the trade turned out to be based on some news/event that wasn’t known prior, you can simply close out the majority of the position after the news is known and leave a “runner” on just in case there is some follow through.

Conclusion

The purpose of this article is to let you know how to find and trade UOA. These are the methods that have been working for me and many others for many years. I hope you find some value in it and share it with others who might find it useful. I also made some videos some time ago that covers the same topic. If you have any questions, just shoot me an email at admin@ivtrades.com.